Salary Slip Format 2022 Details | Salary slip format in Excel | PDF| Word

Payslips are another name for a salary slip. Salary slips contain an employee’s salary details, including earnings such as basic wage, HRA, Conveyance allowances, medical allowances, special allowances, and deductions such as EPF, professional tax, TDS, and loan recovery details. In this article, we will learn all about salary slip format and salary slip details.

Every month, employers distribute salary slips to employees. Many folks do not keep their pay stubs. Some people throw them away, while others misplace them, never to be found again. This post will explain what a Salary Slip, commonly known as a “payslip,” is. How Do I Make a Salary Slip in Excel? In addition, we have given numerous salary slip templates in excel, word, and pdf.

Salary slips are essential, yet most of us are unaware of what they are. We also don’t think it’s our fault. We have still not run the stage where we will require them as an essential. This article will also discuss the significance of wage slips and provide some sample salary slips.

What is a salary slip?

A salary slip also understood as a payslip, contains an employee’s salary details, such as basic pay, bonuses, deductions, and so on, and is sent by the employer each month. The recipients are given either hard or soft copies or both.

All organizations do not distribute salary slips. Smaller businesses do not usually give their employees monthly pay stubs. If employees want to get monthly wage slips, they can request them from HR or obtain a salary certificate.

We strongly encourage you to keep your payslips safe because they will come in useful at times when you will be required to provide them. A salary slip’s format varies based on the organization or country.

Let us learn about the salary slip format.

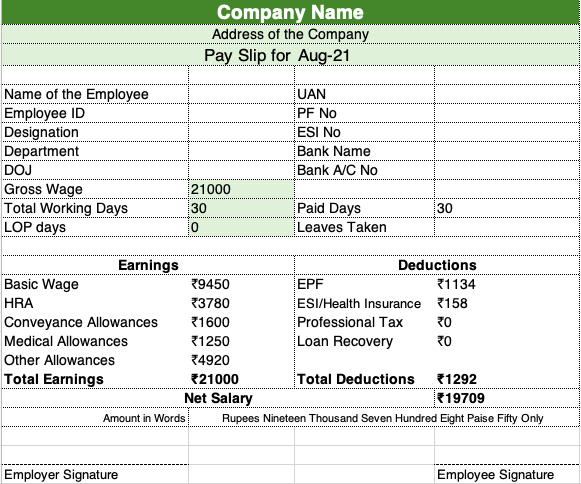

If you want to learn about the salary slip format, here are all the details.

- Salary slip must have company name and company logo.

- Name of the employee to which salary slip is given. Along with the name designation and department of the employee working in the company.

- Essential details like employee ID number, and employees PAN card number or Aadhaar card number.

- Employees bank account number is also a must.

- Employees Provident fund account number (PF number) and details.

- The number of employees’ working days and the number of leaves taken in a month.

- Employees earnings and deductions.

- UAN Number.

- The gross income and net income of the employee.

These are a few essential points that must get mentioned in a salary slip format. In this article, you can quickly learn about the salary slip format in excel and salary slip format in pdf. Let us look at how to create a salary slip format in Excel. You can also easily download salary slip format online.

Download salary slip Format Here

Here we have provided our best details about salary slip format. We have also provided some salary slip format to download.

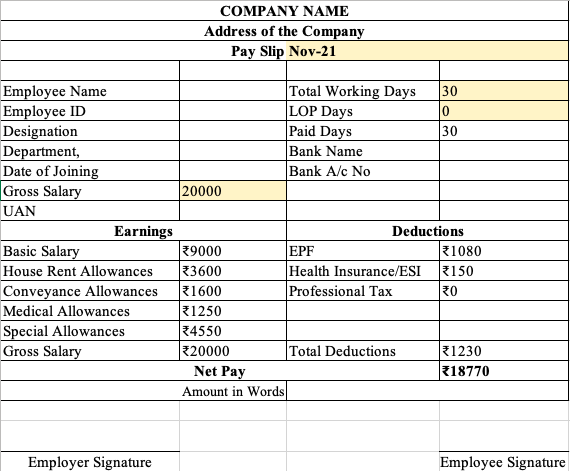

Salary slip format 1

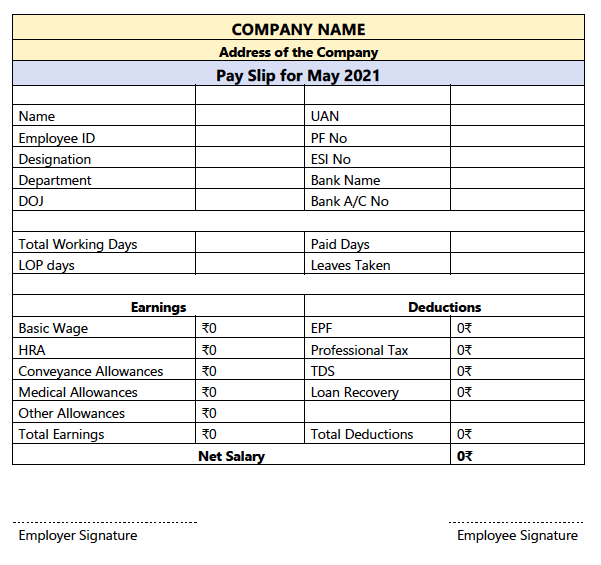

Salary slip format 2

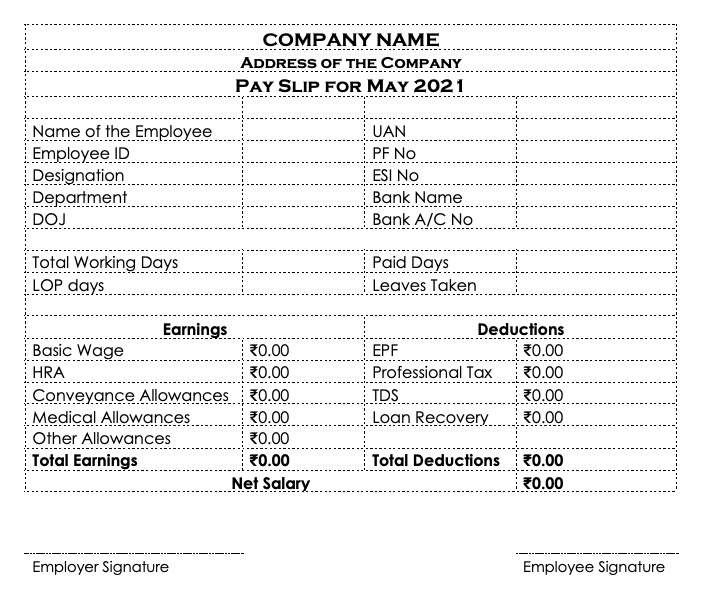

Salary slip format 3

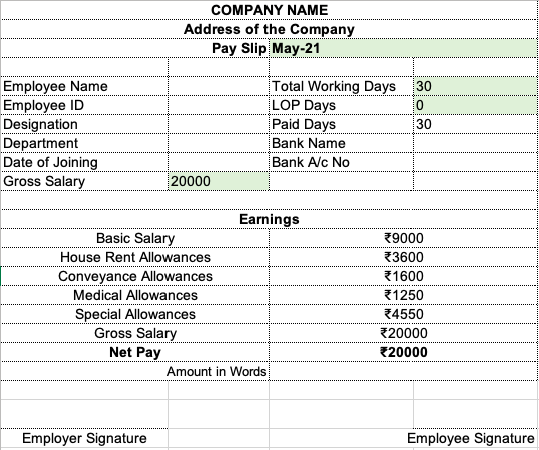

Salary slip format 4

Salary slip format 5

How to create a salary slip format in Excel

To create a salary slip format, open a new Excel document and fill in the first three rows with your company name, address, and payslip month and year. After creating the salary slip, you can convert it into PDF easily, but let us first look into detailed points on making salary slip format in Excel.

- Now enter the employee’s general information, such as name, designation, department, date of appointment, gross salary, bank account information, and other required information.

- Now enter the employee’s LOPs (Loss of Paydays) and the number of days in the month. Subtract LOPs from the number of days in the month to get total paid days.

- Add all employees’ wages, including basic salary, housing rent allowances, conveyance allowances, medical allowances, and special allowances, into one column. Calculate them using the total number of days you have been paid. The employee’s actual gross salary is calculated by adding their earnings together.

- Add deductions like EPF, professional tax, ESI/health insurance, TDS, and salary advances to another column.

- Deduct all of the deductions from the employee’s earned gross compensation for that month, and the remaining sum is the employee’s net salary.

Finally, you may print off the salary slip, sign it, and give it to employees. Creating a salary slip is easy if you know all the essential details. It is necessary to mention all the details and choose a simple salary slip format rather than something that may confuse the employees.

Let us learn about the Importance of Salary Slips.

Salary slips are pretty crucial in the workplace. They are proof that you are a salaried employee in the eyes of the law. As a result, it would be beneficial if you always kept them safe, much like other critical documents. If you get salary slips via mail, keeping them safe is easy.

Make sure you do not delete your meals with salary slips because they will be essential documents when you move to another job or for taking bank loans and also valuable for other aspects. Let me also mention some of the critical points why it is essential to keep your salary slip safe.

- Proof of a salaried employee: Let’s say you wish to apply for a visa or a place at a university. In that situation, you must produce proof of employment in the form of a paper. This is when the money you earn comes in helpful. This will display them your job title and your most recent pay.

- Help to avail loans: When applying for a loan or credit card, the bank or creditor wants to know that you have a solid strategy and a way to pay them back. Your pay stub might serve as proof that you have enough money to pay them back each month (or the payment plan chosen by you).

- Helps in negotiating salary: Pay slips are your weapons during salary negotiations while shifting jobs. You can request a raise based on your most recent pay stub. Furthermore, keep in mind that the HR representative at the new company you’re about to join will ask for your salary stubs from the preceding two months.

- Helps in income tax calculations: The salary slip contains travel, house rent, medical allowances, etc. You can use it to prepare income tax returns. It helps you calculate how much to pay and how much can be reclaimed.

You can also check Latest Biodata For Job Formats | Free Download PDF & Word 2021-22 and Latest Marriage Biodata Format In Words & PDF Formats (2021-22) on our website

More about components of Salary Slip Format

Employees receive income statements from their employers once a month. Although most companies distribute these via email, some still distribute paper copies. If you look at your pay stub(s), you will see several components, many of which you will probably not understand, but don’t worry. We will go over them here.

Income Section

Under the incomes section of the salary slip, the following salary slip components appear:

- Basic salary: The basic salary is an essential component of the salary slip. This is your base salary before any dedication or addition. This accounts for approximately 35% to 40% of your total compensation.

- Leave Travel Allowances: This portion of a wage slip covers the employee’s travel expenses while on leave.

- House Rent Allowances: As the name implies, this supplement the employee’s base wage for housing expenses.

- Variable Allowances: Employees receive variable allowances when they meet or exceed their goals.

- Conveyance Allowance: This pays for the employee’s transportation to and from work.

- Personal Allowance: This component is the amount of income that the employee is entitled to each tax-free year.

- Medical Allowance: This contributes to the employee’s medical expenditures being covered.

- Special Allowance: This component of salary is given to the employee as motivation.

Deduction Section

The following salary slip components exist under the part of the payslip deduction:

- Provident Fund: This is the accumulation of funds for the retirement term of an employee.

- Professional Tax: This is only valid in a few Indian states. A person’s tax bracket determines it.

- Tax Deductible at Source (TDS): The amount shown on this component is computed and devoted by your employer on behalf of the Income Tax agency.

Remember that a salary slip format and components vary based on the firm or country, as there is no standard salary slip format. If you do not receive your monthly pay stubs, you are legally compelled to request them from your employers.

Know Useful Salary Slip Formula

Some of these Salary Slip Excel Formats with predefined formulas have been mentioned. It can assist in calculating gross earnings and deductions.

| Particular | Salary Slip Formula |

| Taxable Income | Gross Salary – Deductions |

| CTC (The total salary package of the employee) | Gross Salary + EPF + Gratuity + Others |

| Gross Salary | Basic Salary + HRA + Other Allowances |

| Net Salary | Basic Salary + Allowances +HRA – Income Tax – Employee’s Provident Fund – Professional Tax |

FAQs

Where and how to get my salary slip?

How to verify a salary slip?

What is the use of a salary slip?

Can HR verify my salary slip details?

Can I edit my salary slip format and details?

What can I do when I don’t have a salary slip?

How can I prove my income when I don’t have a salary slip?

Conclusion

We hope the information about salary slip format, importance, and components provided above helps you learn more about salary slips and their significance.

Rajesh

Salry shilp